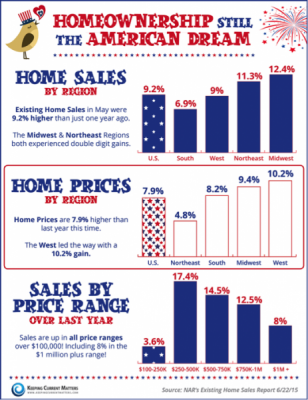

There has been a lot of speculation lately about the importance of homeownership to upcoming generations. While homeownership rates have undoubtedly declined since the housing boom of the mid-2000s, there is plenty of cause for optimism about the future.

First, the National Association of Realtors’ (NAR) latest Existing Home Sales Report revealed that first time homebuyers made up 32% of all sales in the month of May. This marks the highest share since September 2012, up from 27% the same time last year. Comparing the housing market to “Furious 7” for its action-packed season, one realtor noted, “A home plays a central role in every family. And now that the recession is over, we’re seeing more events in the lives of families, including weddings, births, new jobs, promotions, graduations, retirements, separations, and the loss of loved ones. These events are naturally leading to thoughts that it’s time to find a new home.”

Second, plenty of studies have shown that homeownership remains central to the American Dream. In one study from the Federal Reserve Bank of New York’s SCE Housing Survey – 2015, 45.6 percent of renters (of 1,205 households) reported that they would strongly prefer owning. More importantly, 60 percent said it was likely they would own their primary residence at some point in the future; almost 2 of 5 respondents reported a probability of 80 percent or higher.

Third, according to Campbell Surveys research director Tom Popik, a change in financing has made loans more affordable to first-time buyers. In late January, the Federal Housing Administration drastically cut its annual mortgage insurance premium rate. This made 3.5 percent down payment loans affordable to buyers with FICO scores and debt-to-income ratios that would hinder them from getting loans elsewhere.

The conclusion is clear: first-time buyers can help you sell your home. According to chief NAR economist Lawrence Yun, “The return of first-time buyers in May is an encouraging sign and is the result of multiple factors, including strong job gains among young adults, less expensive mortgage insurance and lenders offering low down payment programs. More first-time buyers are expected to enter the market in coming months, but the overall share climbing higher will depend on how fast rates and prices rise.” Take advantage of these buyers in the upcoming months as the market continues to improve.